Final judgment in divorce proceedings

After almost two and a half years of proceedings, we succeeded to bring about a final conclusion to the divorce proceedings. The factual circumstances of the case were complicated by the fact that the spouse we represented was a foreigner, and the parties had three minor children. Thanks to the constant, ongoing assistance provided by our lawyers, however, we managed to achieve a very beneficial effect for our Client - the court determined that the children's place of residence would be with him, and the mother would only have contact with them (to a very limited extent).

A gentle divorce - is it possible?

The decision to end a marriage through divorce is always extremely difficult and must cause great stress for spouses. Obviously, it is in their interest to ensure that at least the formal and legal aspects of this procedure cause as few problems as possible. In recent years, thanks to comprehensive advice, assistance in negotiations and representation in mediation proceedings, we have led to the conclusion of many divorce proceedings in accordance with the needs of our Clients. In a situation in which the spouses manage to work out a common position and all court documentation is professionally prepared, the court case is a formality - the hearing itself can last even less than 20 minutes, and the waiting time for it is only a few months. This solution is definitely better than the long-term battle into which a disputed divorce often turns.

Winning an employment legal dispute with the Bank

After more than 6 years of proceedings, we finally brought to the satisfactory conclusion of the dispute over remuneration for overtime work. The Warsaw District Court held that although the employee was to be employed in a task-based working time system and in a managerial position, the remuneration for overtime work related to the performance of his duties was due to him. The victory is all the more pleasing because it was possible to obtain it despite great evidentiary difficulties - the defendant Bank was not interested in providing numerous documents, despite repeated requests from the Court.

Discontinuation of criminal proceedings

We have successfully defended Clients in criminal proceedings that were legally concluded by discontinuing the proceedings at the preparatory stage - based on Article 17 § 1 item 1 of the Code of Criminal Procedure. As part of providing defense for the Clients, we read the evidence contained in the files of both proceedings, participated in the procedural activities and issued written positions and evidentiary motions in which we drew the attention of the law enforcement authorities to the inconsistencies resulting from the evidence and other substantive and formal premises that justified the termination of the proceedings by discontinuing them even before the indictment was filed with the Court. The authorities conducting these preparatory proceedings issued orders to discontinue with a justification consistent with the Clients' line of defense adopted in these cases. These proceedings concerned, in one case, a collision of cyclists with the participation of the Client on a bicycle path and its effects on the injured party (Article 177 § 1 of the Penal Code), and in the other, the suspicion that the Client had committed, among other things, fraud on BLIK (qualification under Article 286 § 1 of the Penal Code in conjunction with Article 287 § 1 of the Penal Code) and other acts charged against the Client in this case. The course and the way of conclusion of these cases showed how important is the appointment and participation of a defense attorney at an early stage of criminal proceedings, based on the indicated cases this allowed for effective defense on behalf of the Clients and securing the Clients' rights while the preparatory proceedings were still underway.

Victory in a case for payment of a contractual penalty

Recently, we have conducted two commercial proceedings for our Clients in claims for payment brought by entities representing the State Treasury. In both cases, our Clients were independently sued for payment of contractual penalties due to improper performance of contractual obligations.

As part of representation before the competent courts, we developed a strategy based on the interpretation of contractual clauses concerning the impact of force majeure on contractual relations, which in fact released our Clients from liability for failure to perform or improper performance of the contract. Additionally, an argument was presented in the field of contract interpretation, supported by relevant court decisions, according to which doubts regarding the interpretation of the meaning of contractual provisions should be interpreted to the detriment of the party that drafted the contract, while the risk of doubts resulting from unclear provisions of the contract, which cannot be removed by interpretation, should be borne by the party that drafted the contract. In both cases, the contracts of the basic relationship were contractual templates provided by contractors of our Clients.

After both cases were considered at a hearing, both claims against our Clients, considered in commercial proceedings, were dismissed, and the court shared in its entirety not only the arguments regarding force majeure, but also the issue of interpretation of contractual provisions. The judgments are not final.

Change of name and surname

Our Law Firm successfully conducted a multi-year administrative case for the Client, in which in 2020 we applied for a change of the Client's name and surname, after which two negative decisions were issued regarding this application, where the authorities found twice that the Client's family situation, involving a long-term conflict with relatives, did not constitute important reasons within the meaning of the Act on the change of name and surname. We appealed against the final decision of the Mazovian Voivode to the Provincial Administrative Court in Warsaw, which accepted the complaint and annulled the contested decision for reconsideration by the Voivode. At the stage of the proceedings before the Supreme Administrative Court, examining the Voivode's cassation appeal against the judgment annulling the decision of the second instance body, the Supreme Administrative Court dismissed the cassation appeal, after which the administrative proceedings were returned for a new substantive proceeding before the appellate body. During the administrative proceedings, new evidence and factual circumstances were presented related to the important reasons for changing the Client's personal data, which were argued from the beginning. This evidence was supplemented by the Client's written testimony, which led to a positive conclusion of the appeal proceedings in October 2024 by overturning the negative decision of the first instance body (USC) and ruling by the Mazovian Voivode on the merits of the case, ruling to change the name and surname in accordance with the Client's request.

Victory before the Supreme Court

The specific nature of criminal proceedings in military cases means that not only cassation appeals but also appeals against judgments issued in the first instance by the Military District Courts are brought before the Supreme Court. One of our Clients found himself in such a situation. As a result of the appeal filed on his behalf and representation at the hearing in the appeal proceedings, we managed to obtain a far-reaching change in the judgment that was unfavourable to him.

Entrepreneur as a consumer

Since January 1, 2021, in some cases entrepreneurs are treated as consumers. According to art. 5564 of the Civil Code, entrepreneurs (but only natural persons) enjoy consumer rights even if they conclude a contract directly related to their business activity, when it results from the content of this contract that it does not have a professional character for them, resulting in particular from the subject of their business activity, made available on the basis of the provisions on the Central Register and Information on Economic Activity.

In such a case, the entrepreneur does not lose his warranty rights if he did not examine the item at the time and in the manner accepted for items of this type and did not immediately notify the seller of the defect, and in the event that the defect came to light only later - if he did not notify the seller immediately after its discovery.

Child's representative - basic information

Under Polish law, as a rule, the representatives of a minor child are their parents.

However, there are situations when the law excludes the possibility of representing a child by parents. Parents cannot represent a child in legal actions between children remaining under their parental authority and in legal actions between a child and one of the parents or their spouse, unless the legal action consists of a gratuitous gain for the child or concerns the means of maintenance and upbringing due to the child from the other parent. This prohibition of representation applies not only to civil proceedings, but also criminal or administrative proceedings.

In such situations, due to the potential conflict of interests of the child with his parents or siblings, the child must be represented by the so-called child's representative. The child's representative is a new concept under Polish family law, because the regulations creating this institution came into force at the end of August 2024. However, it plays a similar role to a curator representing a child (i.e. to the institution it "replaced").

The child's representative may be an attorney or legal adviser who demonstrates special knowledge of matters concerning the child, of the same type or corresponding in type to the case in which the child's representation is required, or has completed training on the principles of child representation, rights or needs of the child.

If the degree of complexity of the case does not require it, in particular when the guardianship court specifies the detailed content of the activities, the child's representative may also be another person with a higher legal education and demonstrating knowledge of the child's needs. If special circumstances justify it, even a person without a higher legal education may be appointed as the child's representative.

The child's representative in proceedings before a court or other state body shall provide the parents of a child who does not participate in the proceedings, at their request, with information necessary for the proper exercise of parental authority concerning the course of the proceedings and the activities undertaken during them, if the child's best interests do not prevent this.

If the child's development allows it, the child's representative shall establish contact with the child and inform them about the proceedings and the consequences of the actions taken by them.

The guardianship court supervises the activities of the child's representative, familiarizing itself with their activities on an ongoing basis. The child's representative submits information regarding their activities to the guardianship court at specified dates, no less than every four months.

The guardianship court considers the application for the appointment of a child's representative without delay, no later than within 7 days from the date of receipt of the application.

The performance of the role of a child's representative is subject to payment. The amount of remuneration is decided by the court or the body before which the child is represented, applying the relevant general provisions.

Deprivation of the right to sickness benefit

This time, our Law Firm team won two cases on behalf of our Client against the Social Insurance Institution. Due to the fact that she started sick leave shortly after starting work, her employment was considered fictitious and she was deprived of the right to sickness benefit. However, the insurer's decision was issued based on incorrect factual findings, which was proven in two separate proceedings (one before the District Court, the other before the Regional Court).

Assessment of the degree of disability

The efforts of our law firm's team led to the completion of another procedure in line with our Client's expectations - this time it was the assessment of the degree of disability by the Provincial Disability Assessment Team. Extensive argumentation presented in the appeal as well as effective polemics with the conclusions presented by experts in numerous opinions prepared during the proceedings guaranteed our Client rights adequate to his health condition.

Birth certificate problems

A client who was born in the Eastern Borderlands before World War II and has been living in South America for several dozen years came to our office. He obtained a decision confirming his Polish citizenship and wanted to apply for a Polish passport, but he needed to present a Polish birth certificate at the consulate, therefore he asked for help in transcribing the birth certificate originally registered in Ukraine.

The main problem in this case was the discrepancy between the data of the client's parents included in the decision confirming the client's Polish citizenship and those entered in the Ukrainian birth certificate (Ukrainian equivalents of the parents' names were used there). In situations of discrepancies in the data contained in the decision on citizenship and in the birth certificate, it is usually necessary to carry out one of two procedures: changing the content of the administrative decision or rectifying the birth certificate (which, however, requires obtaining and submitting other civil status certificates, in this case - regarding the client's parents). Each of these procedures would lead to increased costs and prolongation of the proceedings in the entire case. However, the case in question was completed without the above-mentioned additional formalities.

Thanks to the discovery of the former passports of the client's parents, on which their data appeared in a form consistent with the content of the decision on the client's citizenship, the Law Firm's team asked a sworn translator of the Ukrainian language to transcribe the names of his parents in the translation of the client's birth certificate based on travel documents or their copies- i.e. in the form of Polish equivalents of their names, based on Art. 14 section 2 of the Act on the profession of sworn translator. On the basis of such a sworn translation, the Civil Registry Office was able to register the client's birth certificate with his parents' data identical to those included in the decision on citizenship, which contributed to speeding up and simplifying the entire procedure and, as a consequence, allowed the client to obtain Polish passport without any problems.

Subject of activity with CEIDG and consumer status

From January 7, 2024, individual entrepreneurs may use the status of a consumer under the contracts they conclude when the content of the contract shows that it does not have a professional character for them, resulting in particular from the subject of their business activity, made available on the basis of the provisions on the Central Statistical Office. Registration and Information on Business Activity (Article 3855 § 1).

Therefore, it should be remembered that entering too broad a scope of activity (as if in reserve) may unnecessarily deprive the entrepreneur of the benefits provided by the status of a consumer, i.e., among others: no prohibited contractual clauses apply to him.

Purported body of a legal person

As of March 1, 2019, there were changes to Art. 39 CC has changed:

Before the amendment, it had the following wording:

Art. 39

§ 1.

Whoever, as a body of a legal person, has concluded a contract on its behalf without being its body or exceeding the scope of authority of such a body, is obliged to return what he received from the other party in the performance of the contract and to repair the damage that the other party suffered as a result of concluding the contract. contract without knowing about the lack of authorization.

§ 2.

The above provision shall apply accordingly if the contract was concluded on behalf of a legal person that does not exist.

However, after the amendment, it was significantly expanded

Art. 39

§ 1.

If the person concluding the contract as a body of a legal person has no authority or exceeds its scope, the validity of the contract depends on its confirmation by the legal person on whose behalf the contract was concluded.

§ 2.

The other party may set an appropriate deadline for the legal person on whose behalf the contract was concluded to confirm the contract; becomes vacant after the ineffective expiry of the specified period.

§ 3.

In the absence of confirmation, the person who concluded the contract as a body of a legal person is obliged to return what he or she received from the other party in the performance of the contract and to repair the damage that the other party suffered as a result of concluding the contract without knowing about the lack of authorization or exceeding its scope.

§ 4.

A unilateral legal act performed by a legal person acting as a body without authorization or exceeding its scope is invalid. However, if the person to whom a declaration of will was made on behalf of a legal person agreed to act without authorization, the provisions on concluding a contract without authorization shall apply accordingly.

§ 5.

The provision of § 3 shall apply accordingly if the legal act was performed on behalf of a legal person that does not exist.

The changes introduced were aimed at improving trading security. They enable the confirmation of contracts concluded by the body of a legal person exceeding the scope of authorization ("false" body). "In the opinion of the draftsman, the proposed solution will remove the legal loophole that the courts must correct by applying Art. 103 CC per analogiam, and will contribute to improving the security of legal transactions, including: by removing interpretation doubts, which will avoid many court disputes and improve the entrepreneur's efficiency, shortening the decision-making process within the unit (Justification of the government project...). The currently applicable autonomy of the will of the parties to the contract in terms of the possibility of maintaining the validity of the contract concluded by the falsus procurator is a more flexible construction than absolute invalidity, which was applicable before the amendment of Art. 39." Ciszewski Jerzy (ed.), Nazaruk Piotr (ed.), Civil Code. Updated commentary Ciszewski Jerzy (ed.), Nazaruk Piotr (ed.), Civil Code. Updated comment published: LEX/el. 2023

A win for an IT employee

Our law firm's team managed to win two related cases within a few months of each other - our client, a former co-worker of one of the IT companies, sued it for damages, and at the same time defended himself (in separate proceedings) against a counterclaim regarding the allegedly due contractual penalty. . Our client's claim was fully upheld by the court, and the former employer's claims were dismissed in full. Both judgments are final.

The Minister accepts the arguments of our Law Firm: a breakthrough in matters of confirmation of Polish citizenship

The Minister of Interior and Administration agreed to the arguments raised by the team of our Law Firm in an appeal against the decision of the Voivode issued in the case of one of our Clients. After examining the appeal, the Minister shared our position that all women born under the Act of January 20, 1920 on the citizenship of the Polish State (i.e. before January 19, 1933), who acquired dual citizenship at the moment of birth, did not lose their Polish citizenship, despite having citizenship of another country.

Thus, there was a breakthrough in the interpretation of the provisions of the 1920 Act regarding the loss of Polish citizenship by administrative bodies - it was recognized that only the acquisition of foreign citizenship subsequent to the acquisition of Polish citizenship resulted in the loss of Polish citizenship. This opens the way to applying for confirmation of Polish citizenship by persons who derive it from women (marital daughters of Polish citizens) born before 1933. So far, public administration bodies assumed that such women lost their Polish citizenship upon reaching the age of majority, when the principle of uniform family citizenship ceased to apply to them.

Transfer of ownership of the apartment as security

As of May 30, 2020, the provision of Art. 3871, under which a contract in which a natural person undertakes to transfer ownership of real estate used to meet his housing needs in order to secure claims arising from this or another contract not directly related to the business or professional activity of this person is invalid, if:

- the value of the property is higher than the value of the monetary claims secured by the property plus the maximum interest for delay on this value for a period of 24 months or

- the value of the monetary claims secured by this property is not specified, or

- the conclusion of this agreement was not preceded by an assessment of the market value of the property by an expert appraiser.

There have been voices in the civil law doctrine that this provision is too casuistic, and "the aim of this provision is the prevention of abuses leading to significant socio-economic consequences, which can also be achieved by existing, more universal civil law instruments, such as the use of the concept of abuse of subjective rights ( Article 5 of the Civil Code), invalidity of a legal act due to violation of the principles of social coexistence (Article 58 § 2 of the Civil Code), defects in the declaration of will (Articles 82-87 of the Civil Code), exploitation (Article 388 of the Civil Code) or protection of a property debtor against over-collateralization (Article 68(2) of the Penal Code)." (Bartłomiej Gliniecki Civil Code commentary updated under the editorship of Małgorzata Balwicka Szczyrba (2023).

For example, in the judgment of February 25, 2022 (II CSKP 87/22), the Supreme Court stated that "the transfer as security of ownership of real estate, the a priori value of which is grossly disproportionate to the amount of the secured receivable and the risk incurred by the creditor when granting loan or credit, may lead to the invalidity of the contract due to the contradiction with the nature of the contract of transfer of ownership as security (Article 58 § 1 in connection with Article 3531 of the Civil Code) and the principles of social coexistence (Article 58 § 2 of the Civil Code)." without referring to the newly introduced Article 3871

Won a disability case

Our law firm's team achieved another success - this time it concerned an appeal against the decision of the Provincial Disability Assessment Team. Despite obtaining a certificate of moderate disability many years earlier, the Team changed the previous assessment of our client's health condition and considered him to be mildly disabled, which resulted in a significant limitation of his rights. After conducting extensive evidentiary proceedings (including a total of 6 expert opinions), the Court agreed with our position in the appeal and changed the ruling of the Panel.

Defense in a criminal case of abuse

Criminal proceedings in which our Law Firm defended the Accused regarding an offense under Art. 207 of the Penal Code (abuse) resulted in acquittal. Thanks to the hard work of the defense attorney (the case lasted over two years and included witness hearings lasting a total of over 20 hours), the court found that the charges against our Client were groundless and the testimony of the witnesses against him was unreliable.

Winning against the Provincial Disability Assessment Team

Thanks to the efforts of our law firm's team, we managed to change the unfavorable decision of the Provincial Disability Assessment Team. For many years, our Client was considered a moderately disabled person, until in 2020, despite the lack of significant changes in his health condition, his disability was assessed as mild. After obtaining a number of unfavorable expert opinions, we managed to convince the court to accept as credible the opinion pointing to serious deficits in the Client's health, justifying his recognition as a moderately disabled person.

Family law cases

The team of our law firm also deals with proceedings in the field of family law, including divorce cases. Thanks to our efforts and the rational approach of our clients and their spouses, we have managed to finalize several cases of this type in recent months. Despite the complicated facts (minor child, dispute over alimony or contacts, etc.), we managed to reach an agreement between the parties, which resulted in a quick and efficient conclusion of the proceedings after one hearing date.

THE CONCEPT OF "DEFECTS" INTRODUCED BY THE AMENDMENT OF THE CIVIL CODE

The Act of November 4, 2022 introduced changes to the following acts: on consumer rights, the Civil Code and private international law. Implementing the provisions of European directives, it influenced the understanding of the concept of defect.

The essence of a defect, within the meaning of the provisions of the Civil Code, is the fact that it results in liability on the part of the seller.

The defect consists in the non-compliance of the item sold with the contract. In the current legal status, the concept of inconsistency of the sold item with the contract includes both physical and legal defects of the item. Changes in the provisions of Art. 556-5563 k.c. removed the - erroneous - identification of non-compliance with the contract with only a physical defect and extended the concept of non-conformity with the contract also to legal defects. Undoubtedly, compliance with the contract should also cover legal defects.

The purpose of the introduced changes was the implementation of European regulations - directives on certain aspects of contracts for the supply of digital content and digital services and on certain aspects of contracts for the sale of goods, amending Regulation (EU) 2017/2394 and Directive 2009/22/EC and repealing Directive 1999/ 44/EC. Both directives are primarily aimed at contributing to the proper functioning of the internal market while ensuring a high level of consumer protection.

Amended Art. 556 [1] of the Civil Code, using the term "in particular", establishes an open catalog of situations in which non-compliance with the contract constitutes a physical defect of the item. It occurs primarily when:

- the item sold does not have the properties it should have due to the purpose specified in the contract or resulting from the circumstances or purpose, and the circumstances do not have to result only from the content of the sales contract, but may also accompany its conclusion (item 1);

- the item does not have the properties that the seller assured the buyer about, as indicated in the doctrine, such assurance may only take place when concluding the contract (point 2);

- the item is not suitable for the purpose of which the buyer informed the seller - when concluding the contract - and the seller did not raise any objections to such a purpose (point 3);

- the item was handed over to the buyer incomplete, according to the settled jurisprudence, this type of defect is not quantitative shortages or delay in delivering the rest of the performance (point 4).

The legislator clearly distinguishes between two possible situations. The first, specified in point 1, takes place when the item is inconsistent with the provision of the contract setting its purpose, and the defect consists in the non-compliance of the item sold with the accidentalia negotii (clauses) of the sales contract. The second one occurs when the sales contract does not contain any provisions informing about its purpose or when the parties to the contract do not make reservations as to the purpose within the contractual provisions. In this case, the non-compliance with the provisions described in point 4 concerns non-compliance with the essentialia negotii of the sales contract, i.e. with materially significant elements - the obligation to transfer ownership and hand over the item in exchange for the obligation to pay the price.

A legal defect is defined in Art. 556 [3] of the Civil Code, according to which an item is affected by such a defect if it is owned by a third party, is encumbered with the right of a third party, or the restriction on the use or disposal of the item results from a decision or judgment of a competent authority. This regulation is particularly important because the sales contract comes into effect when the parties incur solo consensus obligations. Thus, it could happen that the buyer, despite paying the sale price, would not become the owner of the thing sold. In such a situation, it is necessary to determine the seller's liability under the warranty, which is absolute. In the current legal status, however, the Civil Code no longer uses this concept, which has been replaced by "non-conformity of the sold item with the contract". In the case of the sale of a right, the legislator extends the catalog of premises for a legal defect, indicating that it may also consist in the non-existence of the sold right. It should be emphasized, following the judgment of the Court of Appeal in Warsaw of June 27, 2018 (V ACa 1274/17), that the lack of the attribute of the owner on the part of the seller does not result in the invalidity of the sales contract, but the seller's liability for a legal defect.

The amendment to the provisions of the Civil Code was accompanied by amendments to the Act on Consumer Rights. The basic provisions on consumer warranty have just been transferred to the Act of 30 May 2014.

Discontinuation of the criminal case against the soldier

Our law firm's team is successful in representing professional soldiers before military courts. We managed to discontinue the criminal proceedings pending against our client before the Military District Court in Warsaw. In response to our response to the indictment, the Court found that in the case (according to the position presented by us) there are premises justifying the discontinuation of the proceedings for the reasons specified in Art. 17 § 1 point 3 of the Code of Criminal Procedure.

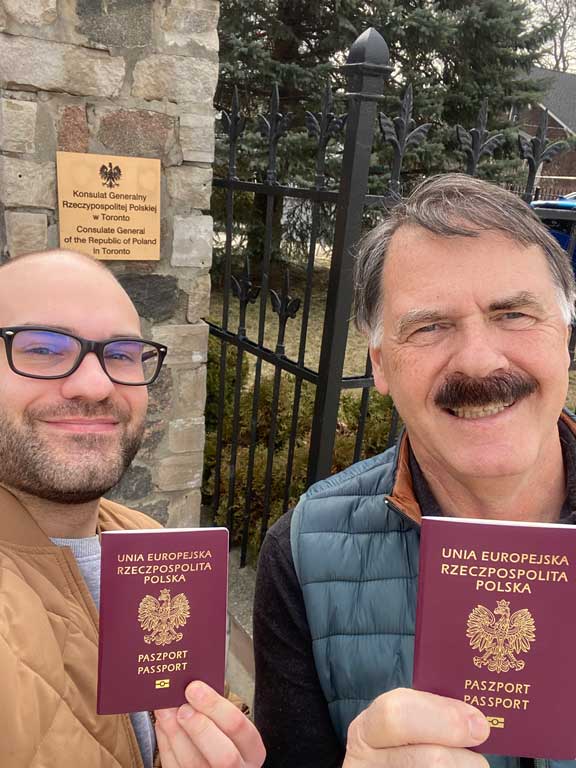

Polish passports for descendants of Polish immigrants

The ancestors of our clients came from the lands located near Kowel, which before World War II belonged to the Second Republic of Poland (now Ukraine). In 1928 the family emigrated to Canada. Descendants of Polish emigrants with Canadian citizenship asked the Law Firm to obtain official confirmation that they have Polish citizenship.

In Poland, the so-called the law of blood, which means that Polish citizenship is passed down from generation to generation. This means that even decades after leaving Poland, it is possible for the family to retain Polish citizenship.

After the Law Firm submitted the application, the Mazowiecki Voivode issued a decision confirming Polish citizenship and our clients could finally receive Polish passports.

Regaining Polish citizenship after 100 years.

A US citizen came to the Law Office asking if he could obtain a Polish passport. His grandfather left Poland over 100 years ago in 1922. Since then, the family had no contact with Poland. My grandfather's Polish passport has not survived either. An additional problem was the fact that the client's ancestors came from what is now Belarus.

Polish citizenship is "passed on" from generation to generation on the basis of the law of blood (ius sanguinis) and if no one has lost citizenship along the way, theoretically there is no limit to the number of generations or the time that has passed since emigration.

After conducting archival searches in Belarus, we managed to obtain documents confirming my grandfather's residence in Poland. Then, the Law Firm submitted an application for confirmation of citizenship to the Mazowieckie Voivode. The voivode issued a confirmation of Polish citizenship and the client was able to obtain a Polish passport.

Conditional discontinuance of proceedings in the case under Art. 178a par. 1 of the Penal Code

Thanks to the efforts of our law firm's team, we managed to obtain a judgment conditionally discontinuing the proceedings in a case concerning driving while intoxicated. This is the third legally completed proceeding of this type in recent months. The arguments we raised that the financial and personal consequences faced by perpetrators of this type of crime are often severe enough to fulfill the justice and preventive function of punishment were once again approved by the Court of the second instance.

Death of the heir during the division of the estate

During the proceedings for the division of inheritance conducted by the Law Firm, one of the participants died. This should result in the suspension of the proceedings until a new circle of heirs is established, which would significantly prolong the entire case. However, before the Court decided to suspend the proceedings, it was possible to obtain a certificate of inheritance from a notary public and the inheritance division could take place between the new heirs, and the case ended without delay.

Effective representation in divorce proceedings

Thanks to the efforts of our law firm's team, we managed to achieve a situation that is rare in the realities of Polish family courts - three minor children of our client, who is a foreigner, will live with him. This decision is part of an extensive and complicated divorce case, but it gives high hopes for ensuring adequate protection of our client's rights and obligations.

Acquittal of an officer of the Polish Army

Thanks to the efforts of our law firm's team, we managed to acquit our client - an officer of the Polish Army - of the fraud charge. The case concerned an allegedly unduly collected settlement allowance and was so strange that, contrary to the position of the Military Police and the District Prosecutor's Office in Warsaw, our client's commander from the beginning claimed that there was no abuse. The judgment of the Military District Court in Warsaw is not final.

Withdrawal of the appeal by the Prosecutor

In matters of driving under the influence of alcohol, we observe stricter regulations, but also an increasingly restrictive approach of the prosecutor's office and courts. Conditional discontinuation of such proceedings is now rare. Therefore, we are all the more pleased that thanks to the help of our law firm, it was possible to protect the client from being convicted. The case was handled by app. adv. Karolina Grąbczewska. In this particular case, no criminal record was a condition for employing the client in his current profession, as well as for his further professional development in the field of aviation. The social harm of the act and the guilt of the Defendant himself was low, which was admitted by both the court of first instance (adjudicating conditional discontinuation of the proceedings) and the prosecutor's office itself. Although the public prosecutor first appealed, he decided to withdraw it during the hearing. As a result, the court of second instance did not have to consider the case in substance and our client obtained a favorable decision.

Reconstruction of the birth certificate

Polish archival resources suffered significant losses during the two world wars as well as the border changes. The Germans and Russians deliberately destroyed and plundered Polish archives. Unfortunately, this means that sometimes, for example, old civil status records cannot be found. They are of great importance, among others in matters of inheritance and in matters of Polish citizenship. In one of the cases conducted by the Law Firm, the client's birth certificate from 1932 could not be found. For this reason, we have submitted an application to the Registry Office to recreate the birth certificate. The Civil Registry Office refused to reproduce the certificate and therefore we brought the case to the court, which granted our application and issued a decision establishing the content of the birth certificate. On this basis, the Civil Registry Office will prepare a birth certificate.

Recovery of seized real estate

Thanks to the efforts of the team, our law firm managed to conclude a long-term and positive family dispute amicably. Our client was deprived of the ownership of several properties, which her mother took over, taking advantage of her mistake and her state of health. As a result of our actions (including both procedural activities and negotiations), all properties were returned to the client.

Housing benefits and housing severance pay

In connection with the entry into force of the Act on the Defense of the Fatherland and far-reaching changes in the interpretation of the provisions of the Act on the Accommodation of the Armed Forces of the Republic of Poland by the Military Property Agency, persons who were refused a housing benefit or housing allowance due to financial assistance received while serving in the Police, The Border Guard or other uniformed services may apply for a change of a decision unfavorable to them. Our law firm deals with this type of case - we invite you to cooperate.

A acquittal in a road accident case

After more than 8 years of criminal proceedings, our team managed to acquit a client accused of causing a road accident. The event took place in Warsaw at ul. Dolna, and as a result of it serious injuries were suffered by the driver and passenger of the motorcycle, who collided with the car driven by the accused. The case was heard at over twenty hearings, and in its course three different expert opinions were allowed (including those from the Jan Sehn Institute of Forensic Expertise). Ultimately, the Court agreed with our interpretation of the facts in the context of the applicable provisions. The verdict is not final yet

Defense of the school principal

The team of our law firm achieved another success - we managed to legally close the case in which we represented the school principal against the parent of one of the students. The subject of the case was the protection of personal rights - the criticism directed at our client, in the opinion of the Court, clearly exceeded the acceptable limits and violated her dignity and good name. The defendant was obliged to prepare a written apology, make a donation for a social cause and reimbursement of costs.

Win in several proceedings against a telecommunications company

By the judgment of the Court of first instance, the claim for payment against the client of our law firm was dismissed in its entirety, and at the same time she was awarded the reimbursement of all costs incurred in connection with the proceedings. The case was unusual in that it was a combination of a dozen or so smaller proceedings - all related to allegedly unpaid liabilities towards an entity providing telecommunications services. The methodical and consistent work of our law firm's team allowed not only to hear all cases within one proceeding, but also to obtain a favorable settlement.

Win against PKP Cargo

Our client, thanks to the help provided to him, won the entire payment case brought by PKP Cargo S.A. The carrier's claim was related to charges allegedly due for the train driver training which the employee used during the employment period. In reality, however, PKP was unable to effectively prove neither the scope of the training provided, nor its duration, nor any costs incurred on this account. The judgment is not final, however, we believe that even in the event of a possible appeal, the Court of second instance will also agree to our position.

Favorable judgment in a case for the protection of personal rights

Thanks to the help of the team of our law firm, it was possible to introduce far-reaching changes to the family court judgment at the stage of the appeal proceedings. After the first instance judgment, the client's trial situation was difficult - he was deprived of parental authority, burdened with high alimony and the obligation to pay large sums to the other party. The appeal made on his behalf and the effective arguments during the hearing allowed for a much more favorable decision - including limiting parental responsibility in lieu of depriving it or reducing the amount of maintenance.

Favorable judgment in a case for the protection of personal rights

Matters related to the protection of personal rights are always complicated, especially if they are related to the divorce. Our team managed to obtain a favorable judgment for the client, in which the court found his mother-in-law's behavior, consisting in publishing unflattering comments on the Internet, violating personal rights. The mere fact that such behavior is unlawful is of great importance for the aggrieved party in many situations.

Conditional redemption

Conditional discontinuation of criminal proceedings is often the most advantageous solution for the perpetrator of the crime - he bears the consequences of his act, but is not convicted, which allows to keep a clean penal record, which is often needed at work. Thanks to the help of our team, it was possible to obtain such a decision in the case of our client accused of driving under the influence of alcohol. The court acceded to the defense lawyer's request and decided that the cash benefit and the driving ban would be sufficient to prevent the perpetrator from returning to the offense.

Success in the case of contacts

The team of our law firm has achieved another success, this time in the field of family law. From January 2021, our client was deprived of contact with his only child due to the activities of the minor's mother. After submitting an appropriate application for security, he was able to guarantee the possibility of seeing his son. The case was unusual in that the client was deprived of parental authority by an invalid court decision in another proceeding.

Win with the Military Property Agency

Our law firm has achieved another success in a dispute with the Military Property Agency. In the decision granting our client - a professional soldier of the reserve, a housing severance pay, the personal status of the household indicated by him (the number of residing family members) was questioned and therefore the amount of money paid to him was limited. Such action was in gross contradiction to the applicable regulations, which was confirmed by the Provincial Administrative Court in Warsaw when examining the complaint submitted by us on behalf of the client. As a result of the justification of the judgment, which was devastating for the Agency, it decided not to file a cassation appeal, and the client was awarded the missing part of the severance pay.

Economic case won

After a long trial, the team of our law firm managed to obtain a judgment dismissing the claim for payment against our client. The case concerned alleged claims resulting from a cooperation agreement concluded between two entrepreneurs - the plaintiff claimed that he should receive additional remuneration from our client, while negating numerous obligations related to, among others, with unsettled cash receipts. The case faced numerous procedural and formal turbulences, but thanks to our efforts and constant supervision, our client finally obtained an enforcement title covering the costs of the trial awarded to him.

Online sales fraud

Thanks to an effective defense in a criminal case carried out by the team of our law firm, we managed to discontinue criminal proceedings against our client. The young man was charged with fraud related to the sale of goods on one of the well-known advertising portals. Actions taken by us, in particular contact with persons conducting the proceedings on behalf of the Police and the Prosecutor's Office, made it possible to clarify the situation and clear our client of the charges.

Closed case for a reserved share

This time, the team of our law firm managed to succeed in a complex case in the field of inheritance law. Our client, acting as the plaintiff, sued his brother for a legitim in 2013. The facts of the case were very complicated - the testator did not leave any property for himself (the whole property was handed over to the Defendant before his death in the form of a donation), and a large part of it (a number of valuable real estate) was sold before the proceedings began. However, thanks to the extensive efforts of our entire team, it was possible to obtain a favorable judgment for our client.

Our clients received Polish passports.

Our clients' family was transported by the Russians to Siberia during the Second World War. After a long wandering, orphaned children ended up in Africa to finally settle in South Africa.

The law firm has prepared and submitted an application for confirmation of Polish citizenship for the descendants of Polish Siberians. The cases were successful and our clients received Polish passports.

Defense of a foreigner in a case of bullying

The law firm's team led to a favorable conclusion of the criminal case in which we had the opportunity to represent the aggrieved party. The foreigner was persistently harassed by a Polish citizen for many years, and she repeatedly made criminal threats against him and insulted him and his family. The prepared notification of the crime was so comprehensive that the Prosecutor's Office decided to submit the indictment to the Court immediately after hearing the aggrieved party and the suspect. The obtained sentence, including not only a suspended sentence of imprisonment, but also a long-term ban on contacts, was entirely satisfactory for our client.

Documents on Polish citizenship

The law firm successfully conducted a case for confirmation of Polish citizenship for a descendant of Polish emigrants of Jewish nationality. Emigration took place in the 20s of the twentieth century and for this reason it was very clear that the ancestors of our client lived at all after Poland regained independence in 1918 on its territory. One of the evidence we referred to was the signature of the client's father on the Polish Declarations of Admiration and Friendship for the United States.

The signatures of the Declaration were collected in 1926 all over Poland, both from representatives of central, church and military authorities and distinguished citizens, but also among students. About 5.5 million of them signed up, including our client's father. The declaration, together with its signatures, had as many as 111 volumes and was handed over to US President Cavin Coolidge on the occasion of the 150th anniversary of the US Declaration of Independence.

Currently, all volumes are scanned and available from the US Library of Congress website.

Malawi Birth Certificate Registration

Malawi is a landlocked country in East Africa. It borders with Tanzania, Mozambique and Zambia. It has a population of 19 million.

Recently, the Law Firm has had the opportunity to pursue a case for registration of a birth certificate from this country at the Registry Office. The document was prepared in English, so for the purposes of its registration it was necessary to order a sworn translation into Polish. The stamp duty for registering a foreign birth certificate is PLN 50.

Documents from "exotic" countries are often unknown to officials of Polish registry offices, therefore their prior legalization is required. It is most often done by obtaining an apostille stamp on a document in the country of origin of the document. If a given country has not signed the Hague Convention of 1961 on the abolition of the requirement of legalization of foreign official documents, it will be necessary to obtain legalization of the document at a Polish diplomatic mission abroad. Malawi has signed the Hague Convention so an apostille can be obtained for Malawi documents.

The Malawi birth certificate registration procedure was successful and the Registry Office prepared a Polish birth certificate for our client.

Effective defense against insults and defamation

Offenses of defamation and insult (Articles 212 and 216 of the Criminal Code) are prosecuted by private prosecution, so it is the aggrieved party, not the prosecutor, who submits and supports the indictment. The lawyers of the Law Firm, acting on behalf of the aggrieved party, managed to convict the client for insult and defamation. A successful young Warsaw businessman found himself in an embarrassing situation when the accused began to direct insults and false accusations against him - by calling his company, coming to the office and sending text messages. The decisive actions of the lawyers before the court led to the conviction and punishment of the guilty, who is additionally obliged to reimburse the victim for the costs of representation.

We have recovered over 30,000 for our client zlotys

Our client provided services to the Developer. Unfortunately, he did not receive the payment due to him. The law firm has prepared and filed a claim for payment to the court. The entire amount sought, including interest, court and attorney fees, was awarded to our client in the order for payment

Unfortunately, there was a problem with the recovery of receivables at the execution stage. It turned out that the debtor (limited liability company) did not have any assets, and its management board was abroad. However, we checked the condition of the land and mortgage registers and it turned out that although the debtor had sold his real estate, it was stated in the sale contract that he had not yet received payment for it. With this knowledge at his disposal, the bailiff could seize the receivables from the sale of real estate by the debtor. Ultimately, this led to our client getting their money back.

Successful negotiation on inheritance.

After the testator's death, it turned out that there were no funds on his bank account. The culprit of this state of affairs was the bank account attorney who, shortly before the death of his principal, paid himself all his savings. The money was taken over without any legal basis (so-called causy), e.g. donation or loan agreements. This means that they were the so-called undue benefit and as such should be returned to the heirs. Fortunately, a lawsuit for the release of the inheritance money was avoided. The law firm sent a request for payment and the subsequent negotiations led to the signing of the agreement and recovery of the money.

Discontinuation of preparatory proceedings

Pursuant to the provisions of the Criminal Code, a person who, at the time of acting, could not direct his / her conduct or understand its significance, does not commit a crime. Thanks to the intervention of lawyers from our law firm, we were able to discontinue the proceedings in our client's case based on this regulation. He found himself in a very difficult situation when, as a result of the drugs administered to him in the hospital, he became agitated and aggressive, which resulted in hitting one of the doctors. Our client did not remember the whole situation and was convinced that if it were not for the drugs, nothing like this would have happened. Nevertheless, the prosecutor's office decided to indict him against him. It was only after the defense lawyer's intervention that the case was transferred to the Public Prosecutor's Office to complete the preparatory proceedings, and then discontinued.

We use consensual procedures in criminal proceedings

Criminal law is one of the basic areas that our law office deals with. In recent weeks, we have managed to complete proceedings in a number of cases with the use of consensual procedures - a motion for a conviction without a trial and a motion for voluntary submission to a penalty (Articles 335 and 387 of the Code of Criminal Procedure, respectively). Thanks to efficient negotiations with the prosecutors in charge of the case and appropriate preparation of clients, we were able to obtain fines favorable to our clients, and to make the proceedings end much faster than it would have been in the case of full court proceedings.

Consensual procedures are often a very beneficial solution for suspects and accused persons, used especially in obvious cases - thanks to reaching an agreement with the Prosecutor or the Court in charge of the case, it is possible to agree on the amount of the penalty and the applicable penal measures, which on the one hand will be adequate to the committed crime, and on the other hand acceptable to the perpetrator.

Coronavirus pandemic

The coronavirus pandemic affects all areas of our life - it has also affected higher education. For several weeks, the media interested in the topic have been warming up the idea of a group of extramural students of the University of Warsaw - they want to demand a reduction in tuition fees in connection with the introduction of remote classes in place of traditional exercises and lectures. Our lawyer, attorney-at-law Piotr Modzelewski, had the opportunity to comment on this subject from the position of an expert: www.eska.pl

Car recovery

The team of our law firm has achieved another success - the Warsaw court has fully admitted the claim for the delivery of a movable property (a car belonging to him) submitted by us on behalf of our client. At the same time, it dismissed the counterclaim filed by the other party in its entirety. What is additionally important, the judgment was made immediately enforceable.

Effective defense in a criminal case

Thanks to the help of our team, it was possible to legally acquit our client of the allegation under Art. 286 § 1 of the Criminal Code. A young woman was accused, along with another person, of fraud in having a car repaired and then driving it from the garage without paying for the service. However, the whole situation turned out to be a misunderstanding - its clarification required an in-depth analysis of the case and effective argumentation before the court.

The amendment to the Criminal Code, which entered into force on March 31, 2020.

The amendment to the Criminal Code, which entered into force on March 31, 2020, increased the threat of punishment in the case of two crimes - art. 161 and art. 190a of the Criminal Code. In the case of the first of them, concerning the risk of infecting another person with an infectious disease, the context seems understandable - this regulation came into force during the coronavirus epidemic. More surprising is the change in the second law dealing with persistent harassment, also known as stalking. It is worth noting that increasing the penalty that can be imposed has far-reaching consequences - including the possibility of conditional discontinuation of the procedure under Art. 190a par. 1 of the Penal Code, and in the case of cases under Art. 161 par. 2 of the Criminal Code, pre-trial detention may be applied

Defense of a professional soldier in WIELKOPOLSKA

Help from a lawyer is valid from the first moments of criminal proceedings. The efficient intervention of our team in the case of a professional soldier in Wielkopolska voivodship convinced the court that it is not necessary to apply temporary detention to him. We treat this situation as the greater success because two other co-suspects in this case have been isolated for 3 months. The order regarding our client was also upheld by the court of second instance.

Help for disciplinary dismissal

Thanks to our help, we managed to quickly end the case of a computer service worker dismissed from work for alleged theft of equipment. In view of the vision of a lengthy lawsuit, we and the client decided to resolve the dispute by negotiation. The parties managed to reach a happy agreement, which allowed our client to obtain the expected compensation and a corrected employment certificate.

The amount of the deposit in the sales contract

In most cases, the down payment is a small part of the cash benefit to be met by the obligated party. It is often 10% of the total amount. The amount of the deposit may, however, be shaped differently by the parties to the contract. The Supreme Court decided that it could constitute even more than half of the main benefit.

The Supreme Court considered the possibility of reserving such a high down payment in the judgment of 31 May 2019. In the cited case (IV CSK 163/18) the plaintiff paid 110,000 thousand. PLN down payment, while the entire property she wanted to buy cost PLN 188,000 zł. The parties agreed that in the event of non-performance of the contract by the buyer, the seller is entitled to retain the down payment of PLN 110,000, while in the event of the non-performance of the contract by the seller, the buyer may demand from it a sum representing twice the down payment, i.e. PLN 220,000. The contract was ultimately not the fault of the buyer, so it lost a high down payment.

Pursuant to art. 394 § 1 of the Civil Code, the down payment given at the conclusion of the contract means that if the contract is not performed by one of the parties, the other party may, without setting an additional deadline, withdraw from the contract and keep the down payment, and if it has given it, it may request the sum twice higher. This situation takes effect in the absence of a different custom or reservation in the contract. The purpose of the deposit is considered to be to strengthen the bond of commitment between the parties. It is to perform a mobilizing, disciplinary and protective function.

The Supreme Court emphasized that a high amount of deposit does not change its legal nature and the effects it produces. It is up to the parties to determine the amount of the deposit, even if its relation to the whole amount is significant.

In the case under consideration, the down payment set by the parties and paid by the claimant exceeded half of the agreed price of the flat. According to the Supreme Court, this did not conflict with the rules limiting the freedom of contracting or the essence of a down payment.

KS

Settlement of a long-standing dispute

The proceedings for payment were pending at the Warsaw Commercial Court between the company and its partner. Aware of the amount of evidence that remains to be taken and the very long waiting times for an appeal to be heard in Warsaw, we decided to convince our clients and the representative of the opposing party to negotiate. The result of long talks was the development of an agreement and settlement, which enabled the company to recover part of its receivables and the partner to sell shares on favorable terms.

Nursing homes and senior homes and their responsibility in connection with the COVID-19 epidemic

Due to the prevailing COVID-19 epidemic, neglections and violations occur in many senior and nursing homes (hereinafter DPS), which may result in the exposure of the charges to danger, and even their infection or finally abandonment without help and care. In such situations, homeowners and their families may require DPS to assume civil and sometimes even criminal liability.

People in the center where the infection occurred may contact the Patient Ombudsman, who launched a special telephone line for this purpose (800 190 590). Soldiers of Territorial Defense Forces also help the charges of DPS in which outbreaks have been identified.

Compensation

If, as a result of negligence of the DPS staff, the mentee has suffered damage (falls ill), a civil suit can be filed against the DPS, demanding reimbursement of costs incurred (including treatment) and compensation - compensation for mental suffering (e.g. fear, uncertainty and a sense of powerlessness caused by illness or leaving the resident without help).

If the home ward dies - his family may demand reimbursement of medical expenses incurred by DPS and compensation for suffering related to the death of a loved one.

Even if the mentee does not get sick or the disease is mild, it is possible to sue DPS. This applies to situations in which the Nursing Home unlawfully violates the personal rights of the mentee - min. his freedom, dignity or honor.

In principle, the DPS's liability will depend on whether or not the house employee was actually at fault in the given situation. The guilt may also consist in violating the rules of behavior (not using appropriate hygiene and preventive measures). Depending on the case, the grounds for liability and the outcome of the case may vary.

Criminal responsibility

In some cases, the behavior of DPS employees may be so grossly inappropriate that it will constitute a criminal offense. A criminal act is exposing a person to the direct danger of losing life or serious damage to health (even unintentionally) as well as exposing another person to a real life-threatening disease (in this case the person must know that he is sick and act with premeditation - want to expose charges in danger) and abandoning the sick despite the obligation to look after them.

In each of these cases, you should report the crime to the police or prosecutor's office. In the course of criminal proceedings, damages and redress can be claimed, provided that the accused is found guilty.

Mandates during an epidemic

In the light of recent reports related to the controversial activities of the Police, imposing fines for various types of alleged violations of the provisions on the conduct of quarantine and the so-called social distancing, we remind you that the mandate proceedings under the law of offenses are not absolute. In a situation in which an officer proposes to impose a fine in the form of a fine, we believe that the offense accused of us did not take place, the best (and at the same time the simplest) action is to refuse to accept the ticket. As a result, the proposed penalty is not imposed, and the case must (together with the request for punishment) be sent to court. It is in court proceedings that we have the best chance to present our arguments and defend our interests. However, it is worth remembering two things - first, if we accept the mandate, in practice we lose the possibility of going to court or withdrawing this statement - the penalty proposed by the officer was imposed, and we have the obligation to pay it. Secondly, in practice the penalties imposed in the form of fines are often (especially in typical, obvious situations) much lower than those used by the courts - remember that the maximum amount of the fine is, in principle, PLN 500, and the court can punish us a fine of up to PLN 5,000, restriction or even imprisonment for up to 30 days, we will also have to cover the costs of the proceedings. You must defend your business, but you must do it wisely. Our law office also provides legal assistance in cases of misdemeanors - judicial proceedings after filing an application for punishment, the accused may have a defense counsel.

The case of the dismissed teacher won

After more than 3 years of litigation in two instances, the lawyers of our office managed to successfully end the case of a teacher unlawfully dismissed from work. The problem was nuanced because there were doubts both about the existence of circumstances justifying the termination of the employment contract with any teacher of a particular specialization, and about the procedure for selecting our client for dismissal. During the proceedings, serious doubts also emerged as to the correctness of the consultation on the intention to terminate the contract with trade unions. Despite the unfavorable judgment before the court of first instance, our appeal was upheld.

Criminal liability and coronavirus infection

Art. 161 par. 2 of the Criminal Code provides for liability up to one year imprisonment for exposing another person (or persons) to contracting an infectious disease. There is no doubt that it also applies to people infected with coronavirus. It is worth remembering this especially in the light of the provisions of the Act on preventing and combating infections and infectious diseases in humans, the Regulation of the Minister of Health on the announcement of an epidemic emergency in the territory of the Republic of Poland and other related provisions on the mandatory quarantine for persons returning from abroad. Our law office offers legal assistance in all matters (including criminal matters) related to the current situation.

Coronavirus - legal advice

Due to the dynamic situation related to subsequent disclosed cases of COVID-19 infection in Poland and measures taken by public authorities to prevent its spread, a lot of information is also penetrating public information regarding the legal aspects of this situation. Unfortunately, many of them are imprecise or even untrue. Our law office offers advice on all legal issues related to the control of infectious diseases, dedicated to both entrepreneurs and private individuals.

Registration of foreign adoption at the registry office

The Law Firm successfully registered foreign adoption at the registry office.

The facts were as follows. The mother of the child immigrated to the USA with a child. There was an adoption trial before an Oregon court. The child's father agreed to be adopted and the child was adopted by his mother's husband - a US citizen. The child took the mother's husband's surname. The American court's ruling became final.

In Poland, however, the child's biological father was still included as the father in the child's birth certificate, and the child's mother's husband did not have any rights to the child. The child was also found in the registers under the previous name. The idea was to enter the mother's husband as the child's father in the register of marital status. This could be done in two ways - either a new child's birth certificate should be entered with the mother's husband as a father, or mentioned in the child's existing birth certificate. Because the US court ruling did not specify exactly how the case was to be resolved, the second solution was adopted and a mention was made of the change of name and new father. From now on, the abridged copies of the child's birth certificate include only the mother's husband as the child's father and the child bears his surname. All child documents will now also be issued in the child's new name.

Win before the Provincial Administrative Court - a special allowance for a professional soldier

The Law Firm's team won another proceeding before the Provincial Administrative Court. This time the case concerned a special allowance due to a professional soldier in relation to the position he held and the nature of the service. It was significantly reduced, and the justification for the decision was very laconic and did not allow to determine what the authority was guided by when issuing it. The Provincial Administrative Court in Warsaw decided that this constitutes such a significant disadvantage of the order under appeal that it should be repealed.

Positive conclusion - driving under the influence of alcohol

Our team has led to another successful discontinuation of criminal proceedings against our client - a professional soldier. He was suspected of causing a traffic collision while driving under the influence of alcohol. The evidence, however, was far from unambiguous, primarily due to the fact that the first breathalyser test only took a few hours from the moment of the incident. Hearing of the suspect and numerous witnesses (each of whom confirmed the sobriety of the driver at the time of getting into the car), and a critical analysis of the retrospective opinion of an expert toxicologist enabled the conviction of the Military Police and Prosecutor's Office that it was impossible to clearly determine the state in which the vehicle was . Therefore, the only possible conclusion was that his behavior was not a criminal offense.

Lawyer Piotr Modzelewski

A positive decision to restore Polish citizenship

After several months of administrative proceedings, the Minister of the Interior and Administration restored Polish citizenship to our client.

Aniela D. (name and surname changed) was born in 1951 in Poland, in Upper Silesia. After finishing education and getting married to a citizen of the Federal Republic of Germany, she left for Germany, where she lives until today. At the time, German law did not allow dual citizenship, which is why Aniela D., to obtain German citizenship, renounced Polish citizenship in 1993. Currently, the regulations allow for having other citizenship alongside German citizenship, which is why the Law Firm, acting on behalf of Aniela D., applied to restore her Polish citizenship. By decision of December 10, 2019, the Minister of the Interior and Administration restored Polish citizenship to Aniela D. Since then, she has two citizenships - Polish and German.

Pursuant to the Polish Citizenship Act of 2009, persons who lost Polish citizenship before 1 January 1999 may be restored to Polish citizenship. Polish citizenship is not restored if someone voluntarily joined the army of the Axis States or their allies between September 1, 1939 and May 8, 1945, or took public office between September 1, 1939 and May 8, 1945. in the service of the Axis States or their allies, or acted to the detriment of Poland, in particular its independence and sovereignty, or participated in violations of human rights. In addition, Polish citizenship is not restored if it constitutes a threat to national defense or security or the protection of public safety and order.

This is one of many cases conducted in our Chancellery regarding the restoration of Polish citizenship and successful.

Attorney Piotr Stączek

Favorable tax changes for heirs

The interpretation of the National Tax Information (No. 0112-KDIL3-2.4011.292.2019.1.MKA) confirmed that in accordance with art. 10 paragraph 5 of the PIT Act from January 1, 2019, the 5-year period from the purchase of real estate, after which you do not have to pay income tax, counts on the purchase of the real estate by the testator, not from his death as it was before.

In addition, it was confirmed that even if the tax must be paid, the income can be reduced by the inherited debts paid (Article 22 (6d) of the PIT Act). Inheritance burdens are understood as the inheritance debts paid by the taxpayer, reserved claims for legacy and ordinary records and orders made, also in the case where the taxpayer has paid inheritance debts, satisfied claims for a legacy or executed ordinary records and orders after a paid sale.

Divisibility of claims after opening the inheritance.

The Supreme Court stated in a judgment of 9 May 2019 (I CSK 198/18) that the claim ceases to be divisible upon entry into inheritance and the heir cannot claim his share. It may turn out that even if a given person is an heir (which is confirmed in the confirmation of the inheritance purchase or confirmation of inheritance), it may turn out that as a result of the division of the inheritance they will not be given the given claim. It may even happen that a given heir will not receive anything if, for example, during the testator's lifetime he received donations covering his entire inheritance share.

Parents bring an action for the child

The Supreme Court in its judgment of 30 April 2019 (file reference number I CSK 79/18) stated that parents can bring an action for the child without the permission of the guardianship court. This is even the case if it involves the risk of losing and burdening the child with the obligation to pay procedural costs.

The overthrow of disinheritance

In its judgment of 30 April 2019 (Ref. No. I CSK 79/18), the Supreme Court stated that those obliged to pay a reserved share may not, in the proceedings for the descendants 'descendants' charge, make the charge of dispossession unfounded. In order to refute disinheritance, he must institute a separate process in which the party will also be disinherited.

Determining the groundlessness of disinheritance may be beneficial for the person obliged to pay a reserved share if the inherited share would be less than for his descendants (i.e. when the disinherited is of legal age and has the right to a reserved portion of 1/2 inheritance share, and his descendant is a minor and has the right to a larger share (2/3 of the inheritance share.

It should be added that in the case of establishing the groundlessness of disinheritance brought by a testamentary heir against the inherited descendant of the testator and the descendant of the disinherited, the minor should be represented by a guardian appointed by a guardianship court (Article 99 in conjunction with Article 98 § 2 point 2 and § 3 of the Civil Code) - cf. resolution of the Supreme Court of 13 March 2008, III CZP 1/08, OSNC 2009, No. 4, item 52.

Thus, the Supreme Court upheld the interpretation presented in the resolution of the Supreme Court of April 22, 1975, III CZP 15/75, OSNC 1976, No. 3, item 38.

Funds on the sub-account at ZUS in the event of divorce

The Supreme Court ruled (decision of April 9, 2019) that the division of joint property includes not only funds in OFEs, but also funds accumulated on the sub-account at ZUS.

Sale of shares in a limited liability company without the consent of the wife

The Supreme Court (judgment of 4 April 2019, file reference number III CSK 146/17) stated that if the shares in a limited liability company are part of the property of the joint spouses, their sale (eg sale or donation) without the consent of the other spouse is invalid , although only one husband is a partner.

How to divide property after a divorce - a new ruling of the Supreme Court

In the case of reference number III CZP 103/17, the Supreme Court, on February 23, 2019, adopted a resolution with the following wording:

"In the case of division of common property after the end of the joint property between spouses, the composition of joint property is determined according to the time when the property cessation ends, and its value according to the state of this property and prices at the time of division."

The supreme court thus crossed the emerging doubts and confirmed the lines of previous case-law. At the same time, due to the fact that a lot of time could have passed since the disappearance of property and property could change, the Supreme Court explained that any property changes that occurred between the moment of cessation of the community and the moment of the department - spontaneous, accidental and intentional, such as natural or physical wear of property components, or even their loss, increase in value due to inputs, material charges, market situation, etc. - are subject to settlement and subsequent compensation in the form of repayments or surcharges. The application of surrogation rules is also not excluded; in this case, the components acquired in exchange for items previously covered by the marital community are subdivided (see the decision of the Supreme Court of 26 October 2017, II CSK 883/16, not public).

No compensation for betrayal of marriage

The Supreme Court in itsjudgment of December 11, 2018 (referencenumber IV CNP 31/17) statedthat no damagesweredue for maritaldecree. At most, youcanapply for a divorce with the guilt of the spousewhocommittedbetrayal for the breakdown of your life.

The sentencepassed in a casethatconcerned a manwhosewifewithouthisknowledgebetrayedhimthroughouthismarriage with hisowncolleague. Moreover, 4 childrenwereborn as a result of betrayals. Eventually, the marriageended in divorce, and the betrayedmandemandedcompensation from his ex-wife and herlover.

The Supreme Court stated in the Polishlegal system that the award of damages for treason was possiblepursuant to art. 29 of the decree of 25 September 1945 Marriage law (Journal of Laws 1945.48.270), which was in forceuntil 30 September 1950 (Article 1 § 2 point 1 of the Act of 27 June 1950. Provisionsintroducing the Family CodeDz .U.1950.34.309). According to itswording, in a divorcedecree, the court, upon the request of aninnocentspouse, willmake the spousepaydamages for the damagecaused by the divorce, and in particular for the loss of benefitsresulting from the matrimonialpropertycontract, and for actsthat form the basis of the divorcedecree ; in addition, the courtmay grant compensation for moralharm. In the currentlegalstate, family law does not establishsimilarclaims to protect the tiesbetweenspousesorkinshiprelationships. Therefore, the award of compensation for betrayalisunacceptable.

Whatismore, the Supreme Court pointed out that the behavior of a wife'slover (having sex with anunhe happy wife) was not prohibited by law, and therefore one can not be heldresponsible for damages.

Thisverdictsuggeststhat the obviousharm to the injuredman and the lack of provisionsprotectinghispersonalrightsshouldresult in the intervention of the legislator

Project Akademia Paragrafu

Towarzystwo Inicjatyw Prawnych i Kryminalistycznych Paragraf 22 (a Non-Government Organisation that advocate Piotr Modzelewski is the Vice-President of) is working on a project called Akademia Paragrafu, which goal is to educate high-school students on law. 100 teams (approx. 300 participants) from all over Poland has enrolled to take part in the project. First educational materials were provided to them on the 7th of October - over 80 pages on criminal and misdemeanor law.

More information on the project can be found here : https://paragraf22.eu/post/akademia/

The legitime is paid also by the heirs of the recipients.

The Supreme Court in its judgment of 13 April 2018 (file reference number I CSK 381/17) stated that the obligation to pay a receipt for receiving a donation is not only gifted but also his heir if he died before the donor.